LC Confirmation – Intro, Function, Feature and Process of That

Introduction: Confirmation of L/C is that the 1st payment obligations undertaken severally by countries bank for the beneficiary on the far side the issue bank.

Functions: Enterprise the credit risks of the issue bank for the bourgeois thus on facilitate exporter receive payments prior to upon obliging presentation; it are often divided into 2 forms: open confirmation and silent confirmation.

Features: Reduction of risks and acceleration of the capital turnover: Confirmation of L/C will facilitate exporters stop the risks from the issue bank, the country risk of issue bank and also the exchange management risks. Double guarantee: except the conditional payment enterprise created by the issue bank, the exporters will get extra conditional payment enterprise from bank or business consultants, putting the exporters beneath double payment guarantee. Payment assortment guarantee: The exporters upon presentation that fits the LC Confirmation needs and approval of the Bank will gain the non-recourse payments or payments guarantees.

Charges Target Customer: 2‰ of the confirmed quantity, with minimum of charged quarterly. The fee can rise subject to the degree of risks of the relevant countries or banks. Exporters would like to get payment confirmation from a bank apart from the issue bank; Exporters would like to get non-recourse funds once presentation of documents notwithstanding the issue bank includes a sensible credit standing.

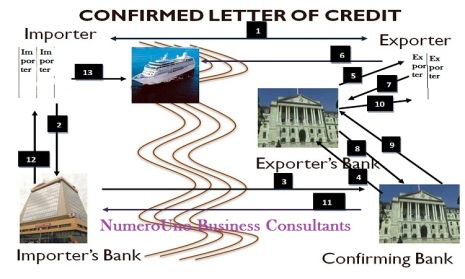

Process: Banks provides insurrection upon the request of the issue beneficiary once advising the letter of credit : the exporter presents the obliging documents to Bank and Bank makes non-recourse payments or irreversible payments guarantees to the exporter once examination and approval; Bank mails the documents to the foreign issue bank to say compensation and can confirm the payment once the foreign payment received.

LC Confirmation (Letter of Credit Confirmation) and Work Flow

What is LC Confirmation?

A second guarantee, in addition to a letter of credit, that commits to expense of the letter of credit. A confirmed letter of credit is typically used once the availability bank of the letter of credit may have questionable trustworthiness and thus the trafficker seeks to induce a second guarantee to assure payment.

In different word a letter of credit is also a document issued by a bank that allows the holder of the letter to draw the funds as declared on the letter from the availability bank. In distinction to a confirmed letter of credit, if the seller does not acquire the second guarantee, the document would be said as an unofficial letter of credit.

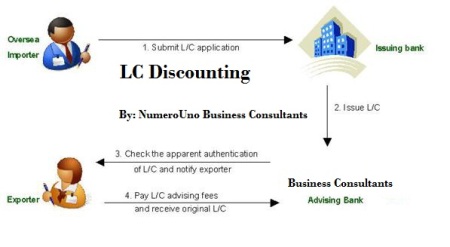

Letter of Credit Advising Flow

When a Letter of Credit (LC) is issued, the LC issue Bank sends the LC either to its branch workplace or correspondent bank that is often set within the seller’s (beneficiary) country. The branch workplace or correspondent bank that receives the LC is understood because the Advising Bank.

The seller can request the buyer to specify his own banker as the Advising Bank. However, if the seller’s bank does not maintain correspondence relationship with the Issuing Bank, the Issuing Bank may appoint another bank as the Advising Bank, which may in turn utilizes the service of the seller’s bank as the second Advising Bank.

The roles of the Advising Bank are:

- To attest the LC to confirm that the LC comes from a real supply. Authentication is either within the kind of signature verification or via SWIFT authentication; and

- To inform the vendor on the arrival of LC in his favors once the LC is prepared for assortment.

An issue Bank that utilizes the services of an Advising Bank or second Advising Bank to advise a LC should use an equivalent bank to advise any consequent amendment(s). If there’s a modification to the LC, the terms and conditions of the first LC Confirmation can stay in effect till the vendor communicates his acceptance on the modification to the Advising Bank or gift documents that go with the amended terms.